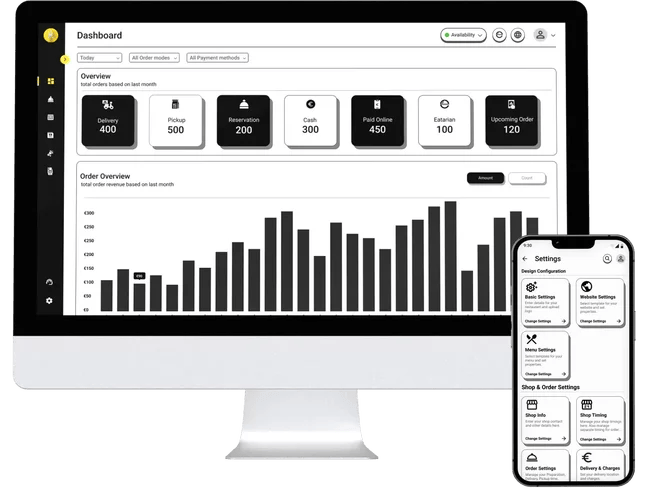

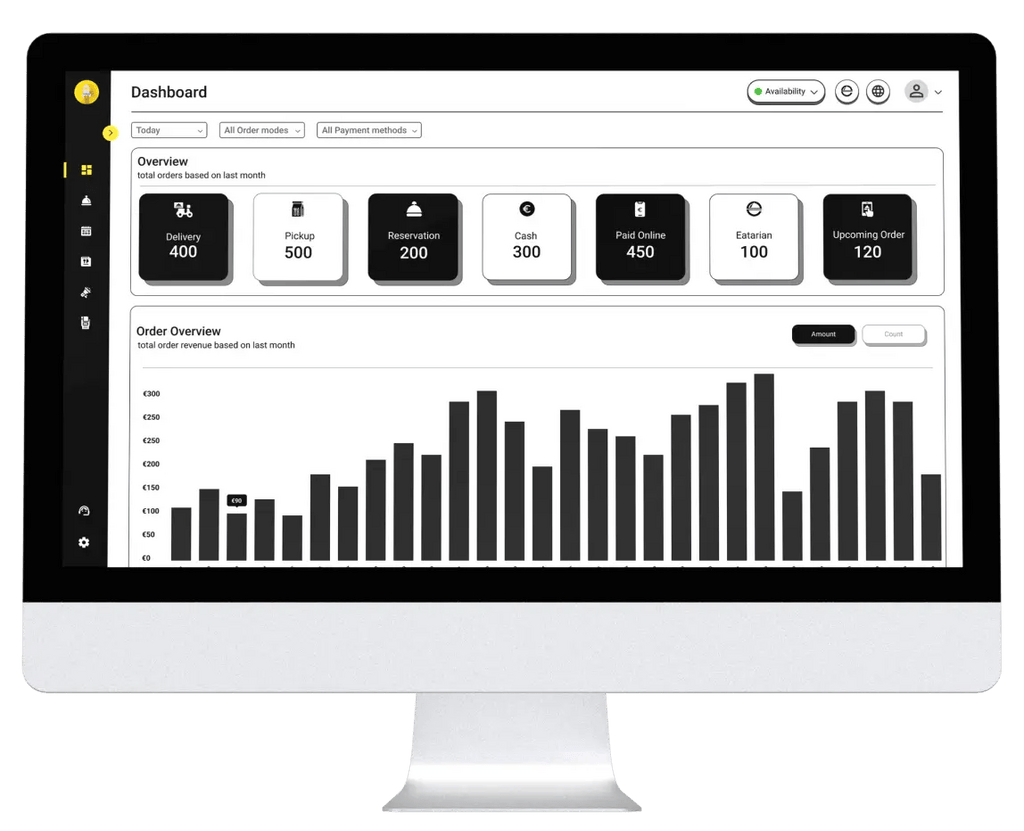

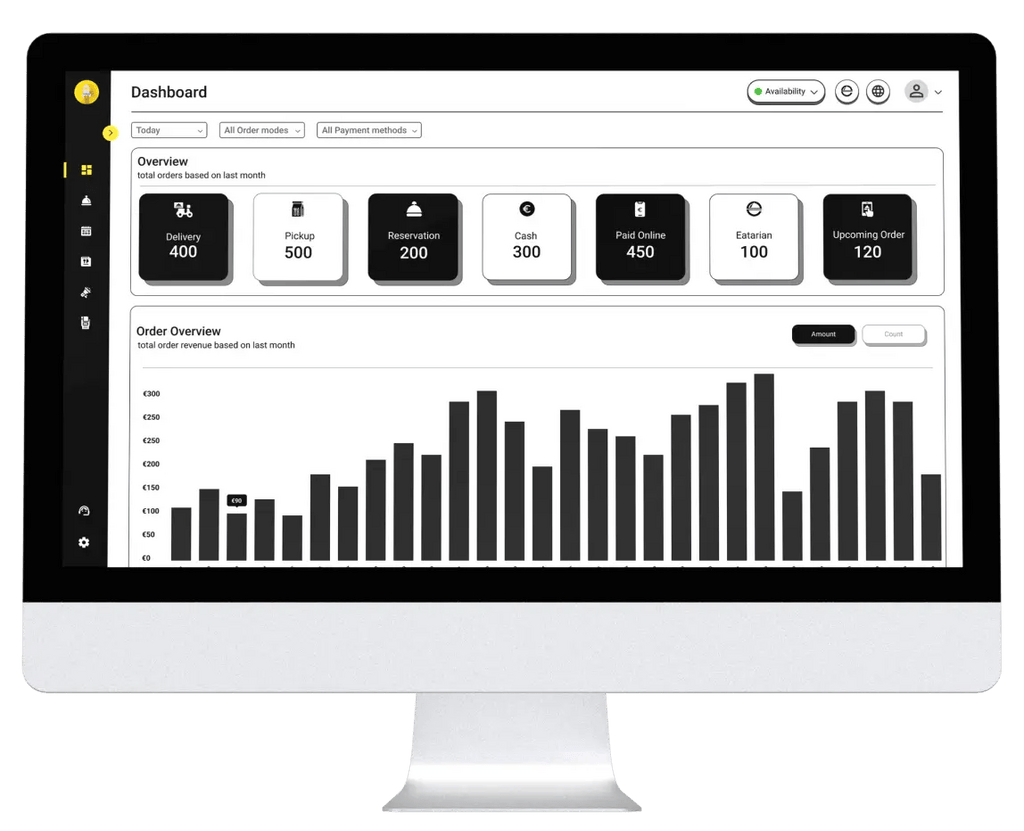

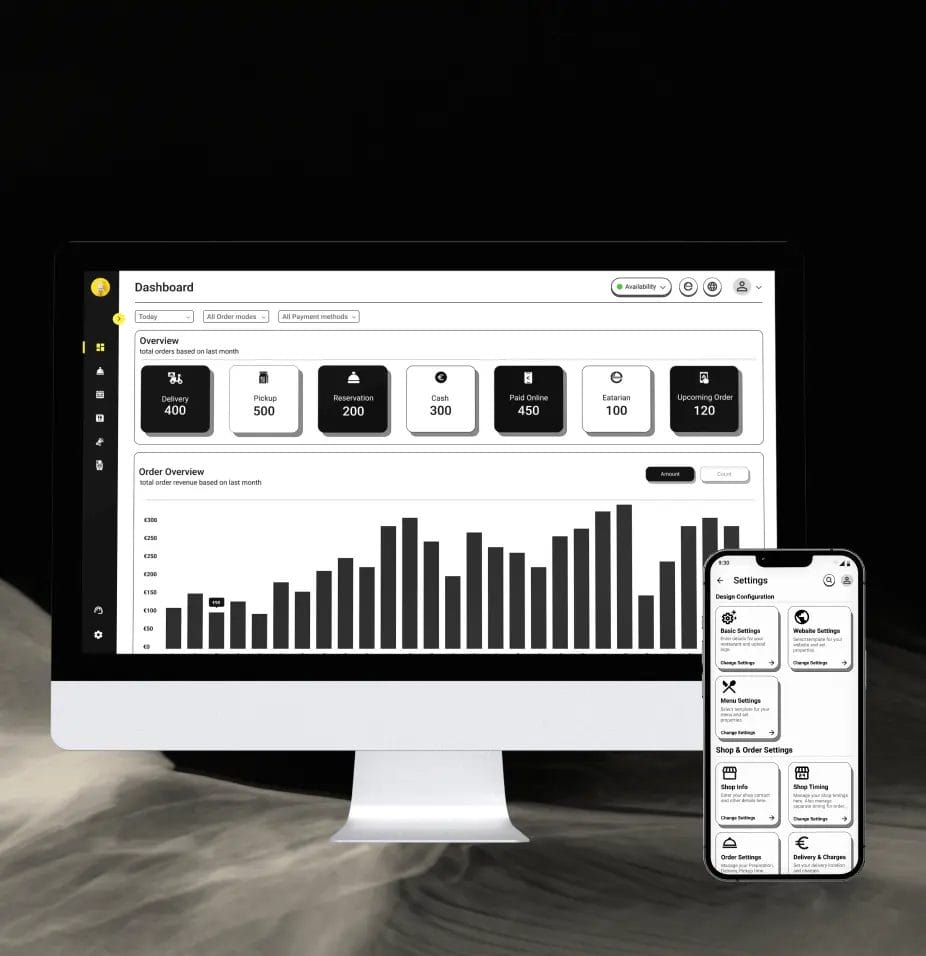

Take charge of your online orders, reservations, menus, offers, and streamline operations with ease using a single dashboard. Your comprehensive portal for top-notch restaurant management.

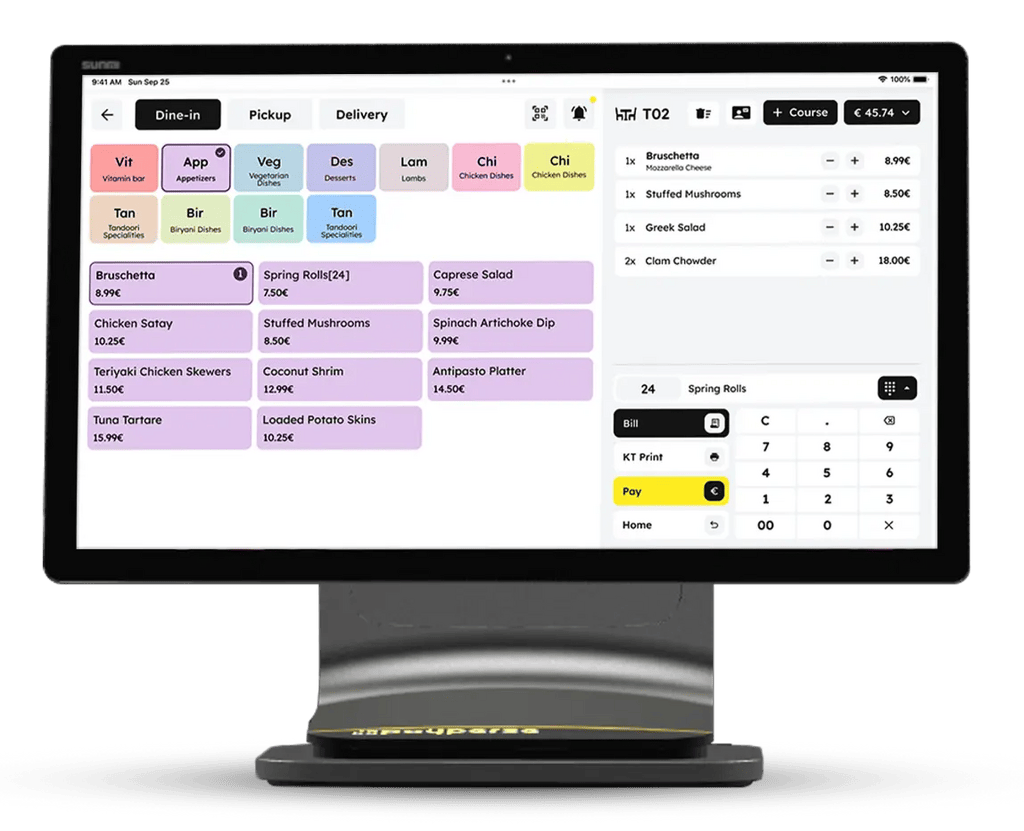

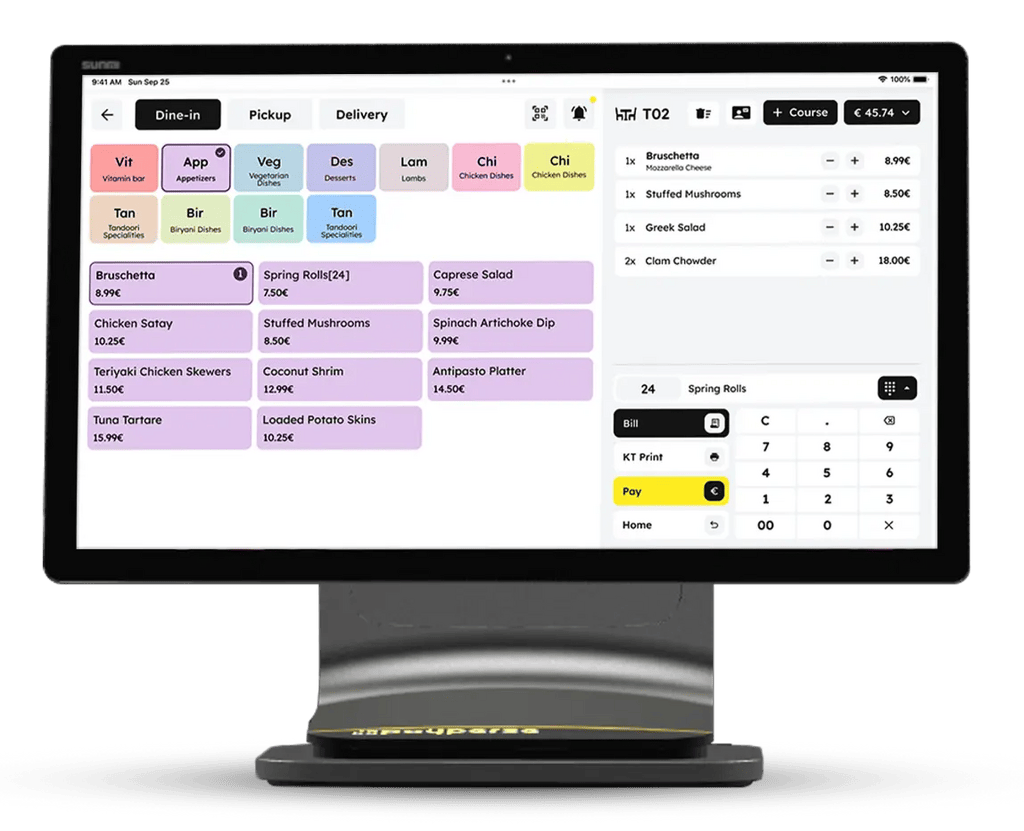

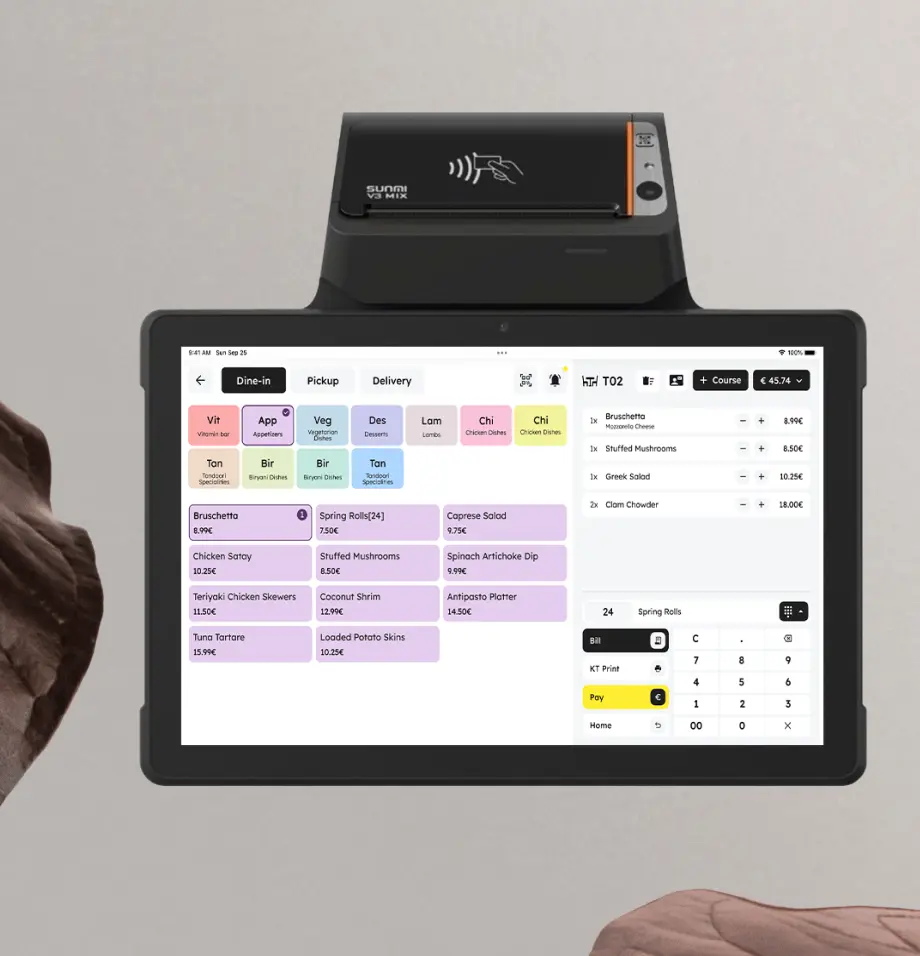

Unified POS for online and offline orders, well integrated and TSE compliant. Enjoy unlimited waiter app access. Effortlessly sync with various third-party software for enhanced functionality.

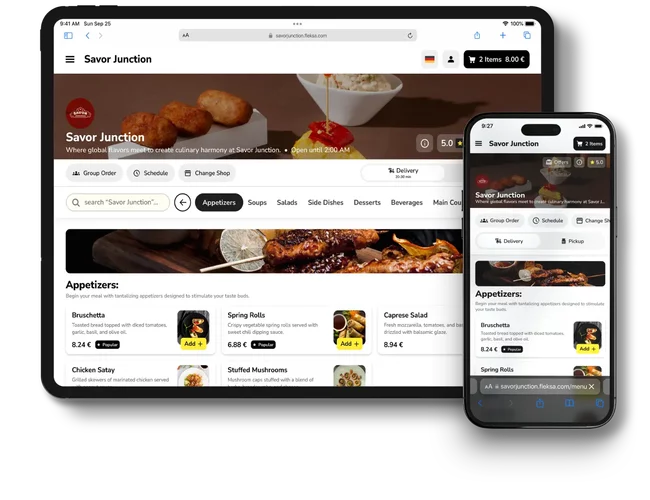

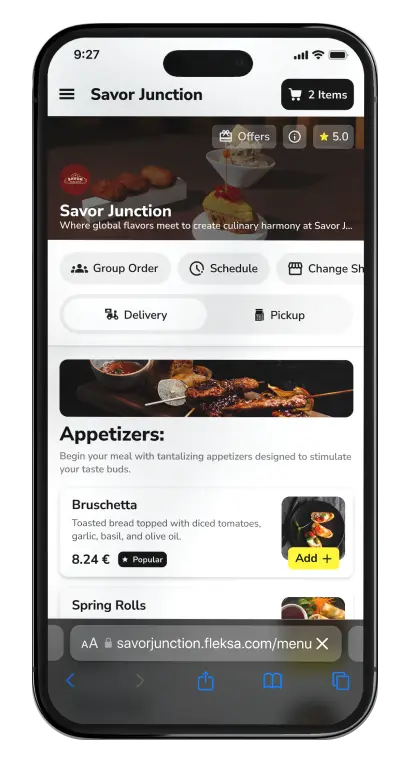

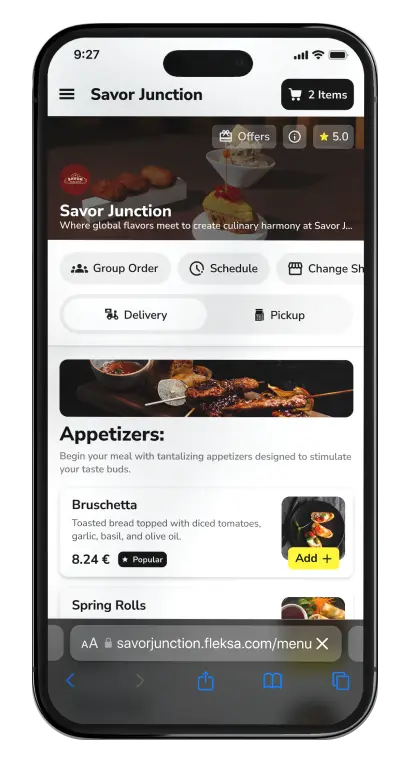

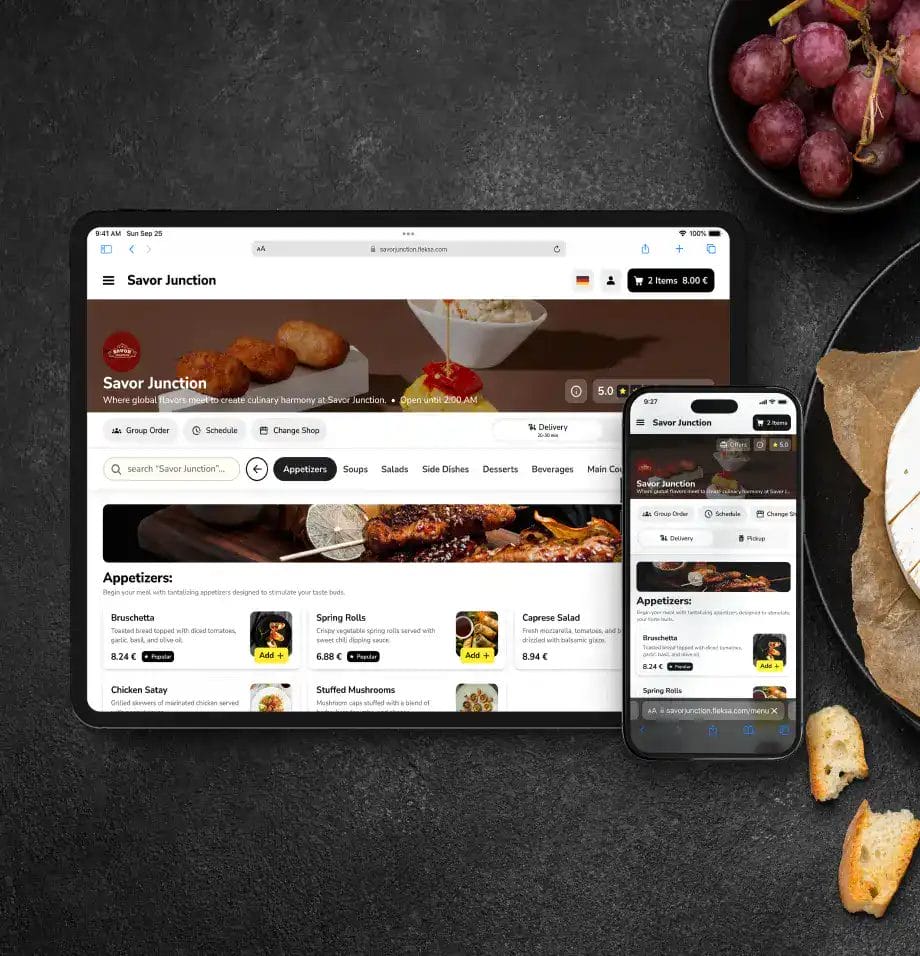

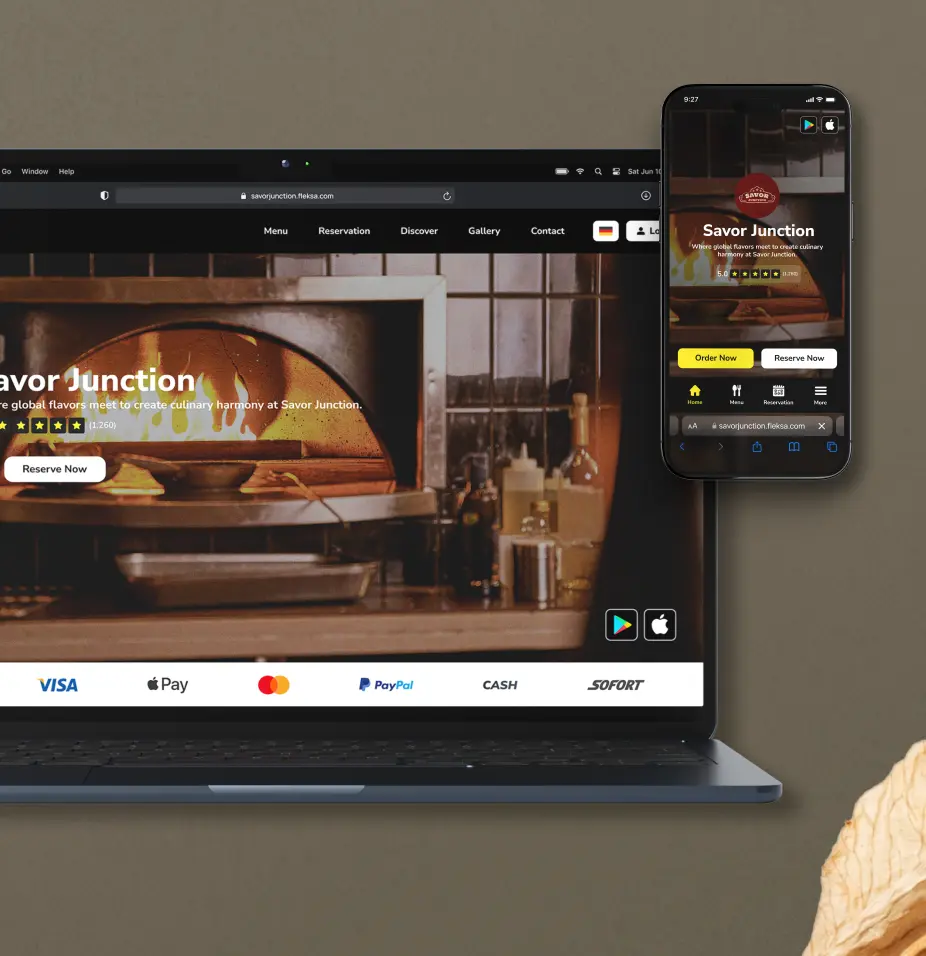

Online ordering system which is equipped with multilevel menu, quality food images and multi-payment channel.

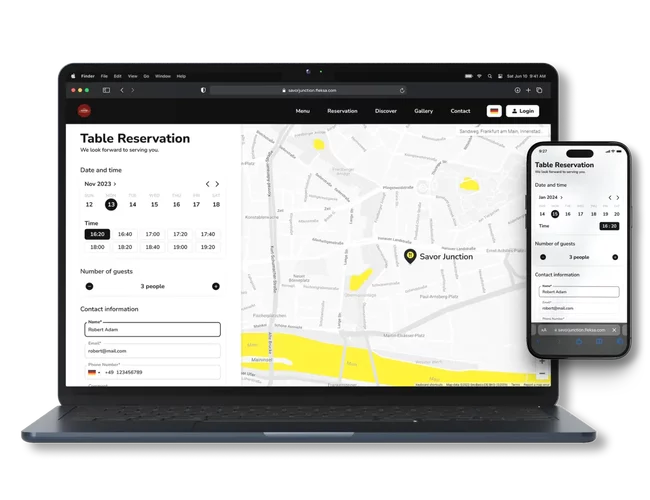

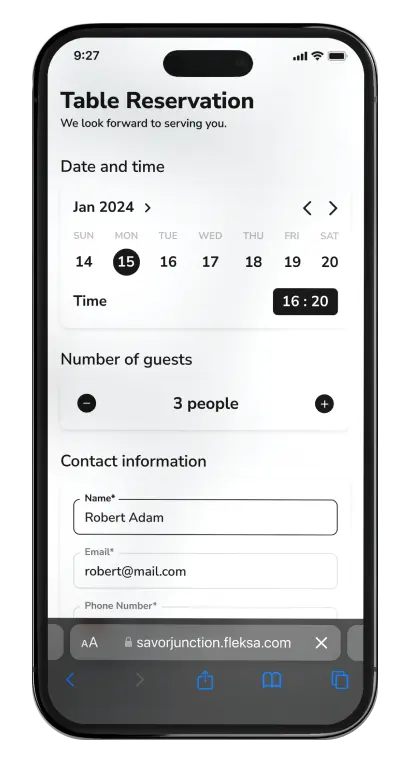

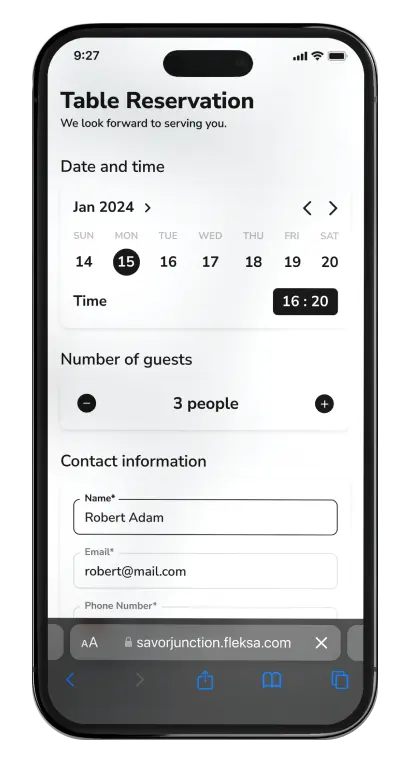

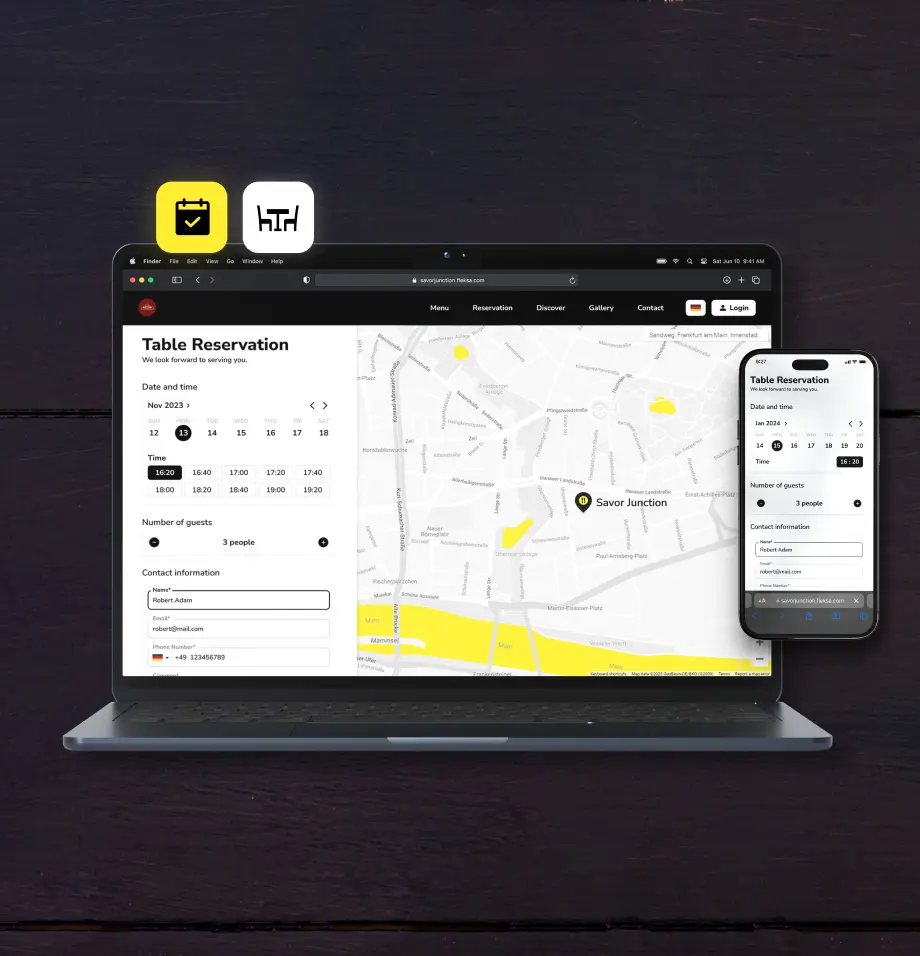

Accept table reservations on your website and also directly on Google search.

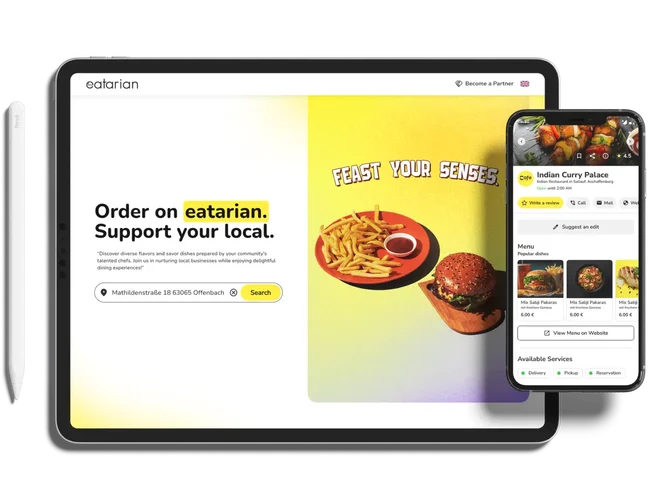

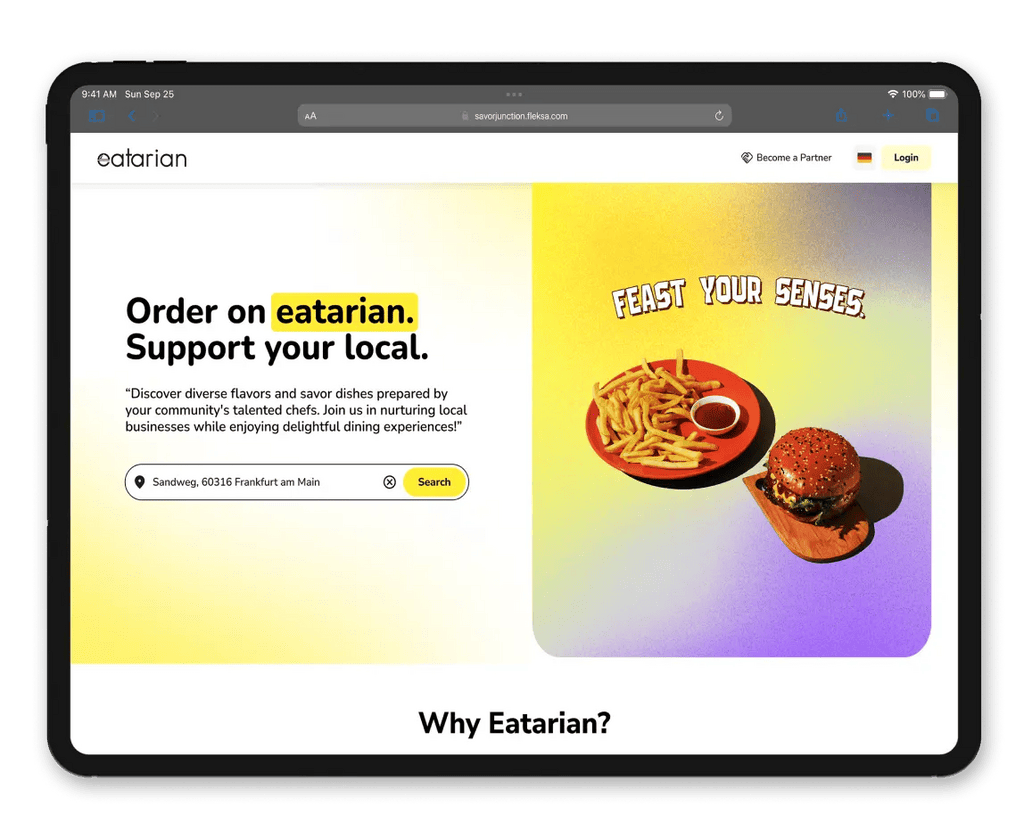

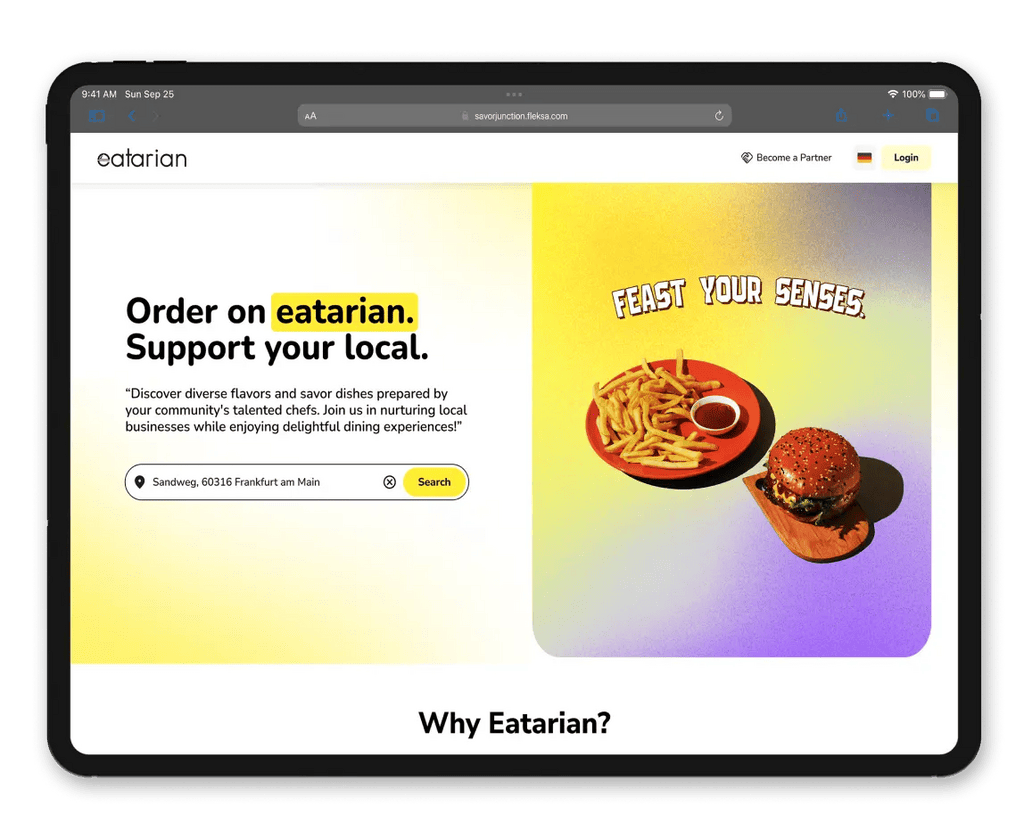

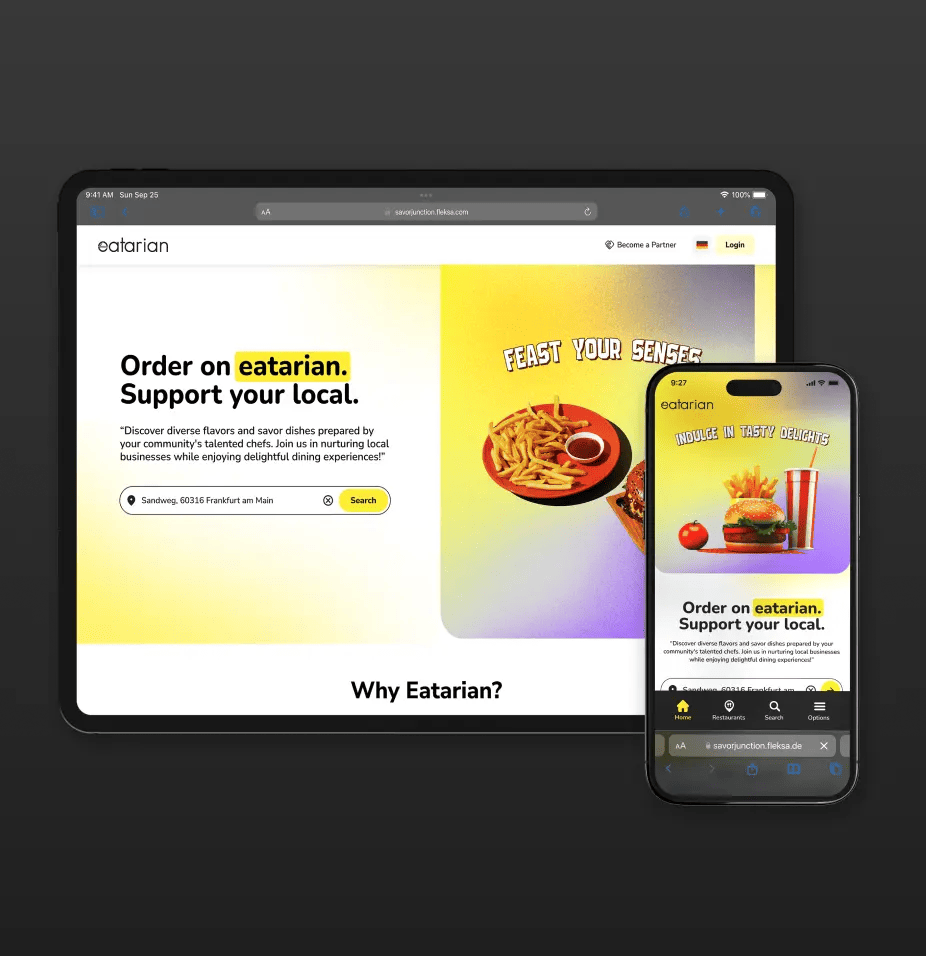

Eatarian boosts your restaurant’s visibility, making it easily discoverable by diners. A commission free platform that connects local restaurants and food lovers easily.

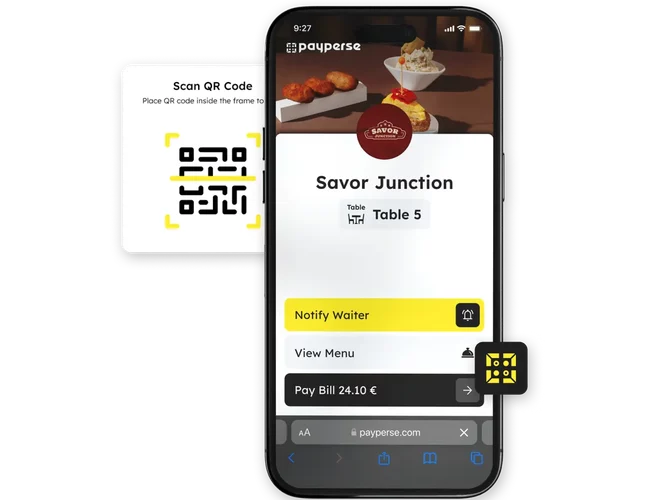

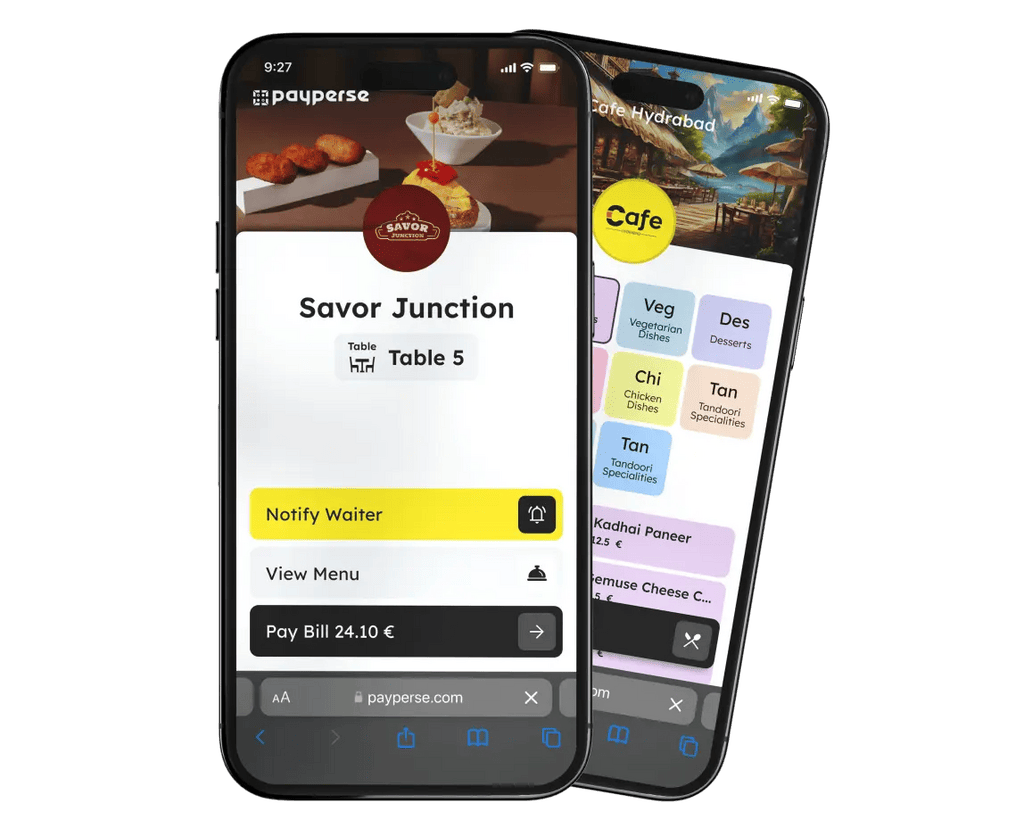

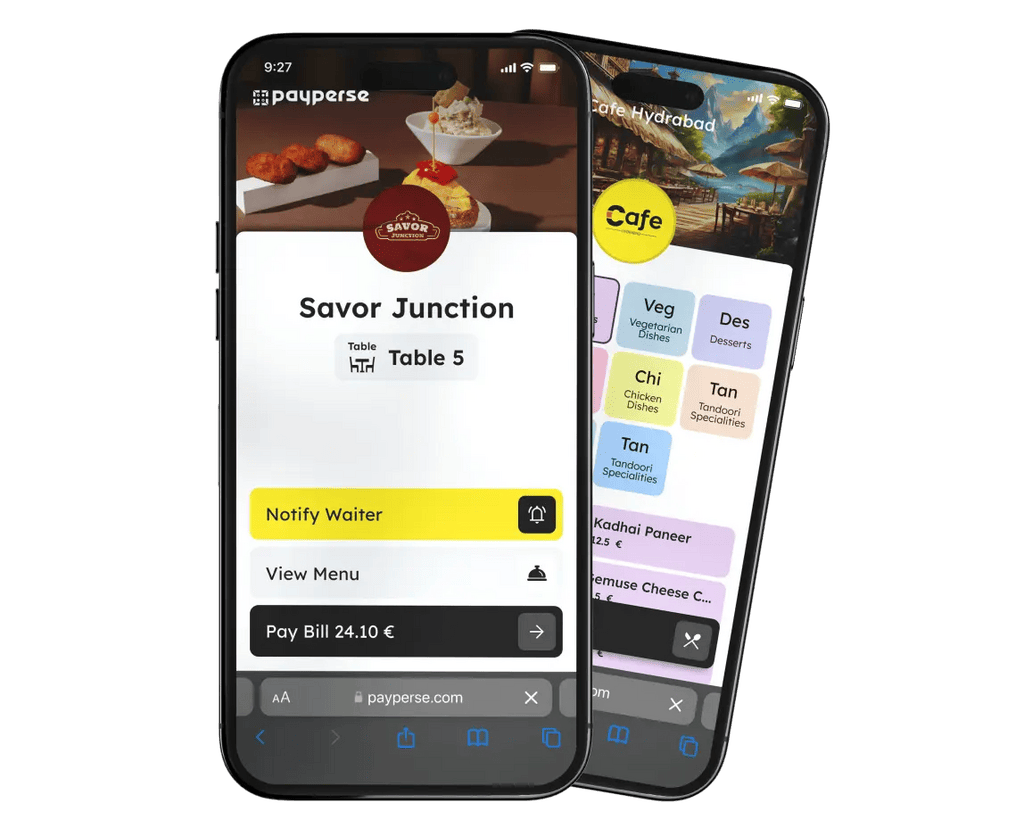

With just a simple scan of a QR code on their table, customers can instantly access menus, place orders, and securely make payments. Elevate customers’ experience by reducing wait times and enhancing overall satisfaction.

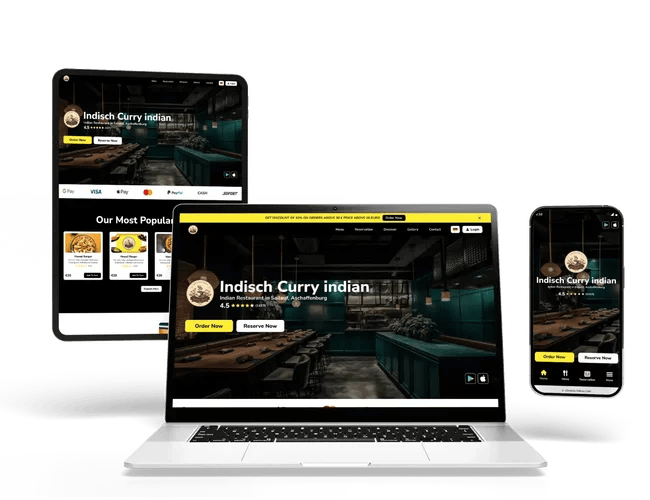

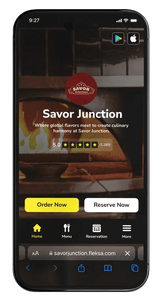

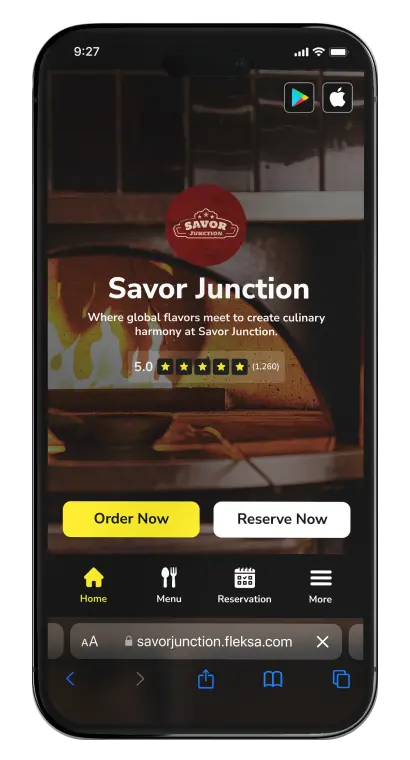

Accept orders and reservations directly through your branded website and app. Zero commission fees, no third-party apps required.

Access to power your own data with fleksa powered automated marketing tools.

Take charge of your online orders, reservations, menus, offers, and streamline operations with ease using a single dashboard. Your comprehensive portal for top-notch restaurant management.

Unified POS for online and offline orders, well integrated and TSE compliant. Enjoy unlimited waiter app access. Effortlessly sync with various third-party software for enhanced functionality.

Online ordering system which is equipped with multilevel menu, quality food images and multi-payment channel.

Accept table reservations on your website and also directly on Google search.

With just a simple scan of a QR code on their table, customers can instantly access menus, place orders, and securely make payments. Elevate customers’ experience by reducing wait times and enhancing overall satisfaction.

Eatarian boosts your restaurant’s visibility, making it easily discoverable by diners. A commission free platform that connects local restaurants and food lovers easily.

Accept orders and reservations directly through your branded website and app. Zero commission fees, no third-party apps required.

Access to power your own data with fleksa powered automated marketing tools.

Manage all orders in one place using our commission-free online ordering system. Access both online and offline orders in a single window to streamline operations and enhance customer satisfaction. Our platform seamlessly integrates multiple ordering & delivery systems, consolidating orders for easy management.

Fleksa’s cutting-edge table reservation system redefines the dining experience. Empower your customers with 24/7 table bookings, seamlessly integrated into your website. Effortlessly manage live reservations and optimize floor arrangements with just a few clicks for unparalleled sophistication in restaurant operations.

Enhance your restaurant operations using Fleksa’s Cloud POS solution designed to meet all your needs. Easily handle dine-ins, online orders, reservations, payments, and deliveries while ensuring seamless operation in your kitchen. Manage all your restaurant tasks effortlessly with this all-in-one POS system.

Concentrate on your cuisine while we support your success in spreading the message. Our expertise lies in restaurant marketing, covering social media management, strategic advertising campaigns, print marketing, loyalty programs, and more. Let Fleksa assist you in establishing and enhancing your brand presence with our customized solutions.

Start taking orders and reservations directly through your restaurant’s website and app without any third-party fees. Fleksa provides customizable web and app solutions, featuring engaging digital menu and multiple payment integrations.

Welcome to Eatarian, where delectable flavors meet discoverability. Let us assist your restaurant in gaining attention from a wider audience of diners. In Eatarian, customers can find the local restaurant, explore their menu, and conveniently place orders directly from the restaurant’s site

Streamline your ordering and payment process effortlessly with Payperse – just a single scan is all it takes. Elevate your restaurant’s efficiency with Fleksa’s QR order and payment system. Allow your customers to conveniently utilize our QR technology for seamless ordering and direct payment right from their tables.

Streamline your restaurant operations easily through Fleksa’s partner portal. Take control of your restaurant business using our comprehensive management system, handling your website, menu, offers, loyalty program, and orders all in one convenient hub. Elevate your management experience with Fleksa’s user-friendly platform.

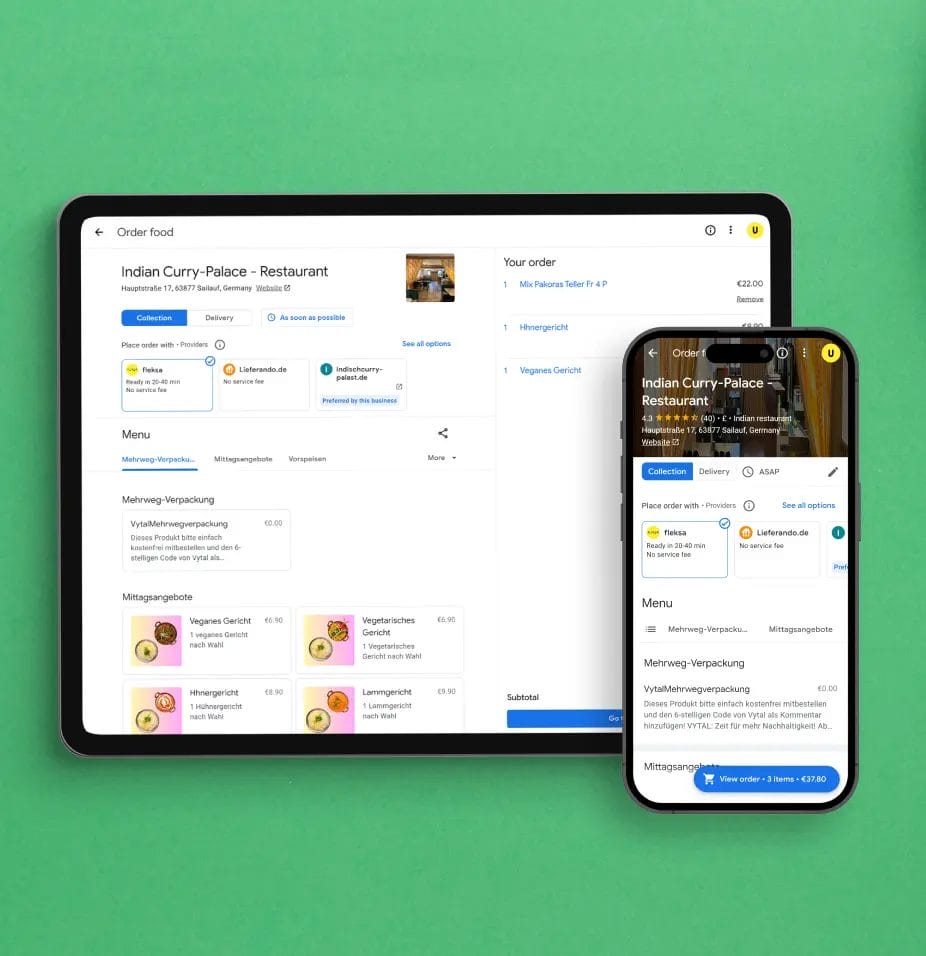

Level up your restaurant’s success using Fleksa & Google Food Ordering Integration. Expand your customer reach, increase orders, and watch your business flourish. With Google Food Ordering, customers can easily discover and order from your menu, making it simple to boost your sales and grow your restaurant.

As a restaurant owner, I have been searching for a seamless way to manage orders and payments, and Fleksa has truly been a game-changer. The QR-Bestell- und Bezahlsystem is so easy for our customers to use and it's made our entire process more efficient. I can't recommend Fleksa enough!

Owner of Schmidt's Bistro

In the fast-paced restaurant industry, having a reliable and effective system like Fleksa's QR-Bestell- und Bezahlsystem is absolutely essential. Not only has it improved our ordering and payment process, but it's also given us more time to focus on what truly matters - our customers. Fleksa is a must-have for any restaurant!

Proprietor of Weber's Gaststätte

Fleksa's QR-Bestell- und Bezahlsystem has completely transformed the way we handle orders and payments at our restaurant. It's incredibly simple to use and has significantly reduced the time it takes for customers to order and pay. Fleksa is a game-changer and I can't imagine running our restaurant without it.

Owner of Müller's Speisehaus

Join 1000+ restaurant owners who are using fleksa to avoid high commissions and increasing their online orders and reservations.

Support Your Local Powered by Fleksa

© All rights reserved by Fleksa